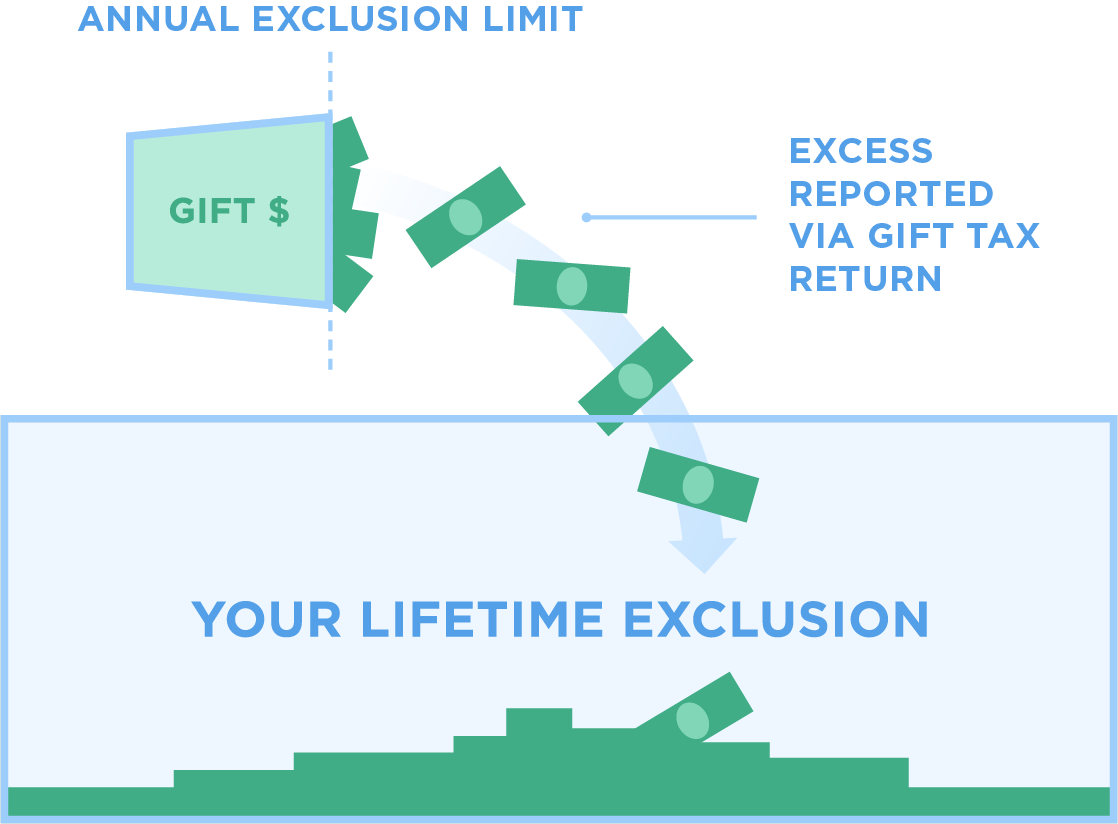

2024 Gift Tax Exclusion Per Person Per Year. This is the maximum amount you can gift to an individual without filing a gift. Starting on january 1, 2024, the annual exclusion on gifts will be $18,000 per recipient (up from $17,000 in 2023).

In 2024, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability. The irs has specific rules about the taxation of gifts.

2024 Gift Tax Exclusion Per Person Per Year Images References :

Source: sarahqguenevere.pages.dev

Source: sarahqguenevere.pages.dev

Annual Gift Tax Exclusion 2024 Amount Chart Dina Myrtia, A married couple filing jointly can double this.

Source: audraymorganne.pages.dev

Source: audraymorganne.pages.dev

Lifetime Gift Tax Exclusion 2024 Per Person Piper Brittany, If you gift more than that, you.

Source: orazitella.pages.dev

Source: orazitella.pages.dev

Annual Gift Tax Exclusion 2024 Per Person Peg Martguerita, Married couples can each gift $18,000 to the same person, totaling $36,000, up from $34,000 in 2023.

Source: callieychristine.pages.dev

Source: callieychristine.pages.dev

Estate Gift Tax Exemption 2024 Pippy Jsandye, 2024 federal estate and gift tax amounts.

Source: ilyssaqcissiee.pages.dev

Source: ilyssaqcissiee.pages.dev

Annual Federal Gift Tax Exclusion 2024 Niki Teddie, The federal gift tax annual exclusion applies to gifts made to each individual donee on an annual basis.

Source: jamiyginelle.pages.dev

Source: jamiyginelle.pages.dev

Lifetime Gift Tax Exclusion 2024 Rayna Mireielle, Married couples can each gift $18,000 to the same person, totaling $36,000, up from $34,000 in 2023.

Source: gabeybardelle.pages.dev

Source: gabeybardelle.pages.dev

Lifetime Gift Tax Exclusion 2024 Pdf Codee Devonna, The federal gift tax annual exclusion applies to gifts made to each individual donee on an annual basis.

Source: brenynadiya.pages.dev

Source: brenynadiya.pages.dev

2024 Gift Tax Exemption Amount Aida Shelia, How much money can you gift?

Source: jessqsimone.pages.dev

Source: jessqsimone.pages.dev

Lifetime Gift Tax Exclusion 2024 Per Person Neala Viviene, A married couple filing jointly can double this amount and gift.

Source: tishaazquintina.pages.dev

Source: tishaazquintina.pages.dev

Lifetime Gift Tax Exclusion 2024 Per Person Maude Sherill, How much money can you gift?