Estimated Tax Payments 2024 Forms. You must pay estimated tax if you expect to owe $500 or more in minnesota income tax after subtracting your withholding and refundable credits. Individuals, including sole proprietors, partners and s corporation shareholders, may need to make estimated tax payments if:

View amount due, payment plan details, payment history and scheduled payments; They expect to owe at least $1,000 when they file.

Estimated Tax Payments 2024 Forms Images References :

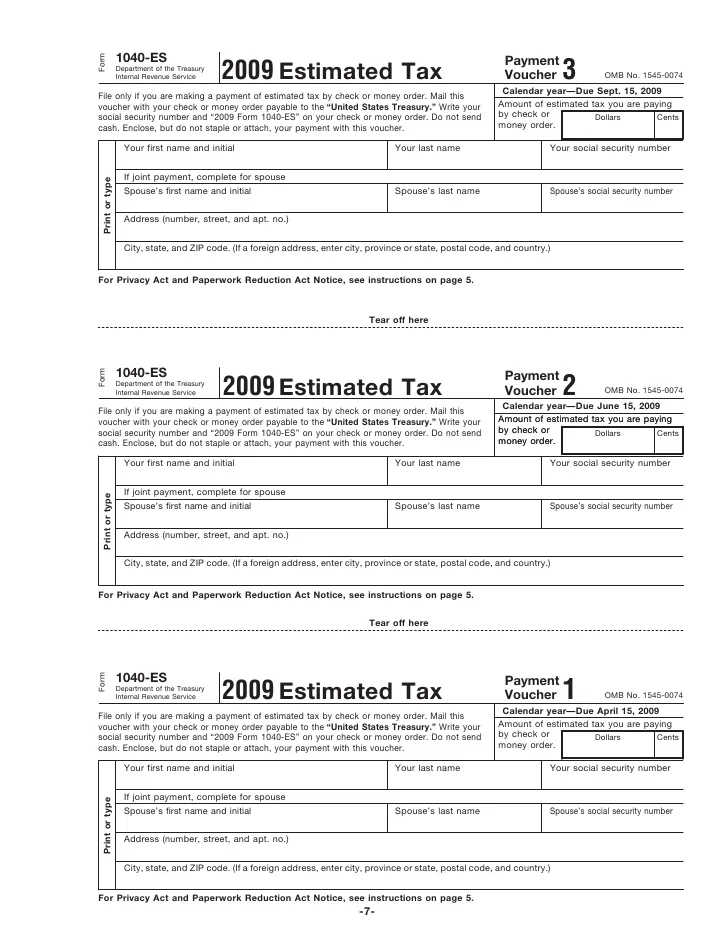

Source: cherilynnwflora.pages.dev

Source: cherilynnwflora.pages.dev

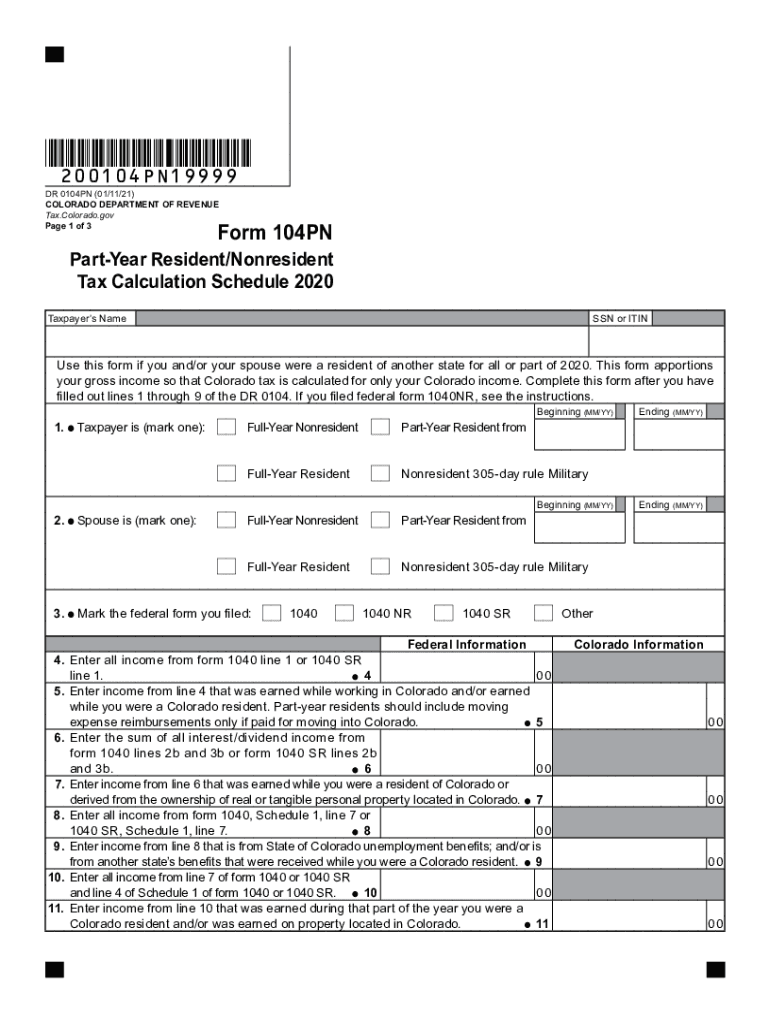

Federal Estimated Tax Payment Form 2024 Mimi Susann, Utah estimated tax rules for residents and nonresidents.

Source: brierqverina.pages.dev

Source: brierqverina.pages.dev

Estimated Tax Payments 2024 Form Berna Cecilia, You can make an estimated payment online or by mail.

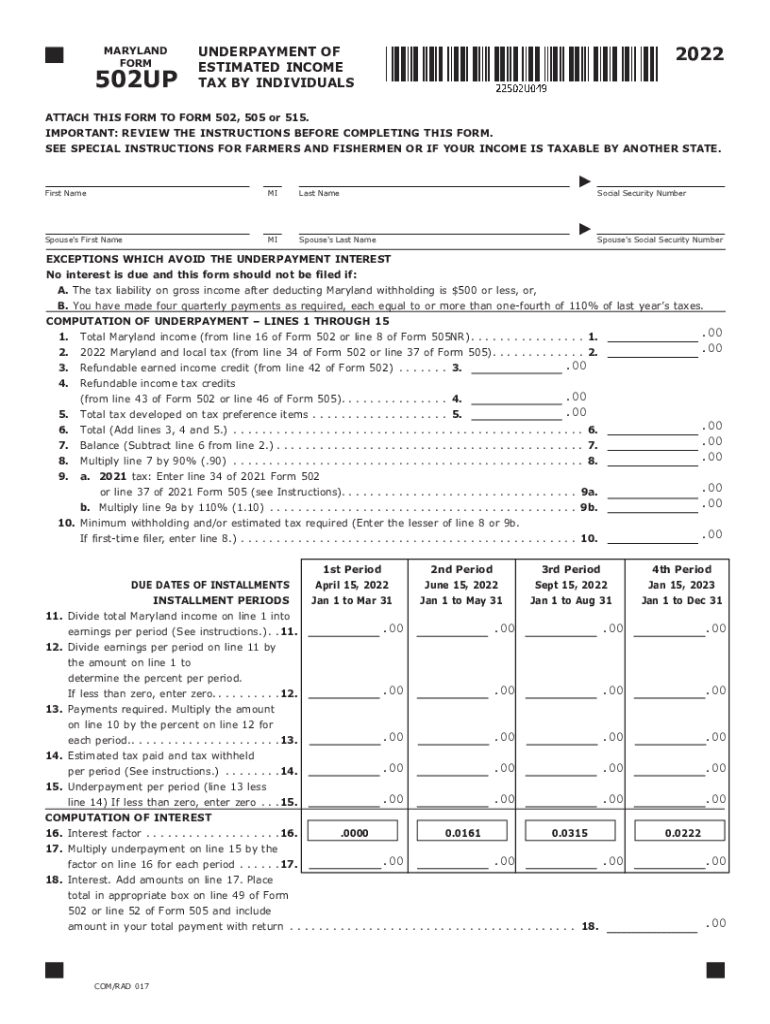

Source: ernalinewgrata.pages.dev

Source: ernalinewgrata.pages.dev

Federal Estimated Tax Forms 2024 Erin Odessa, You are required to pay estimated income tax if the tax shown due on your return, reduced by your north carolina tax withheld and allowable tax credits, is.

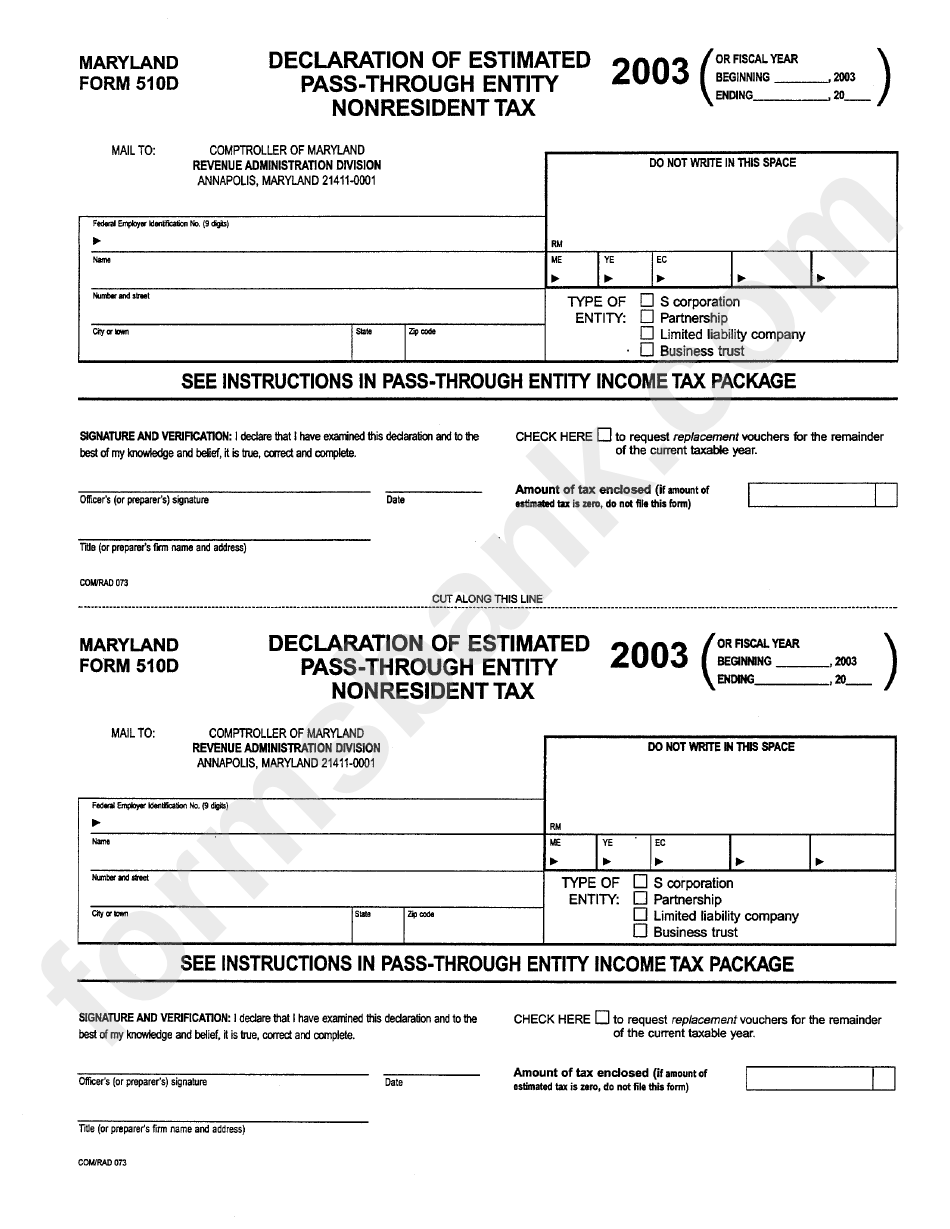

Source: edinyevelina.pages.dev

Source: edinyevelina.pages.dev

Estimated Tax Payments 2024 Forms Printable Hanni Kirsten, If you expect to owe money come tax time, the government will likely make you pay estimated quarterly tax payments.

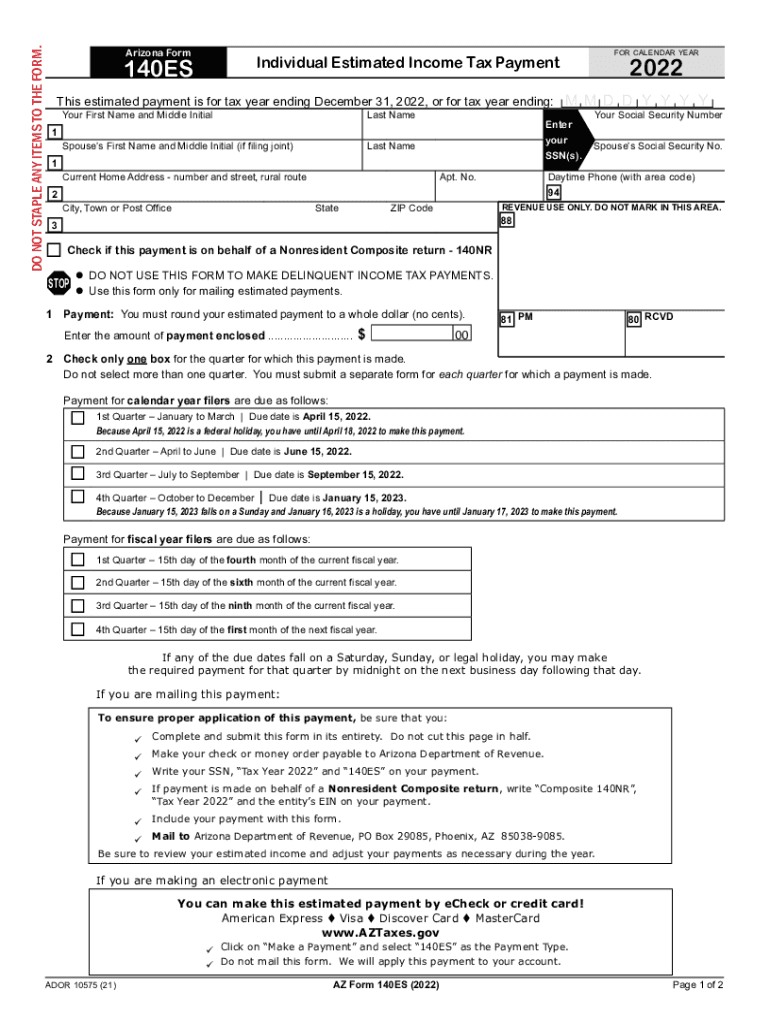

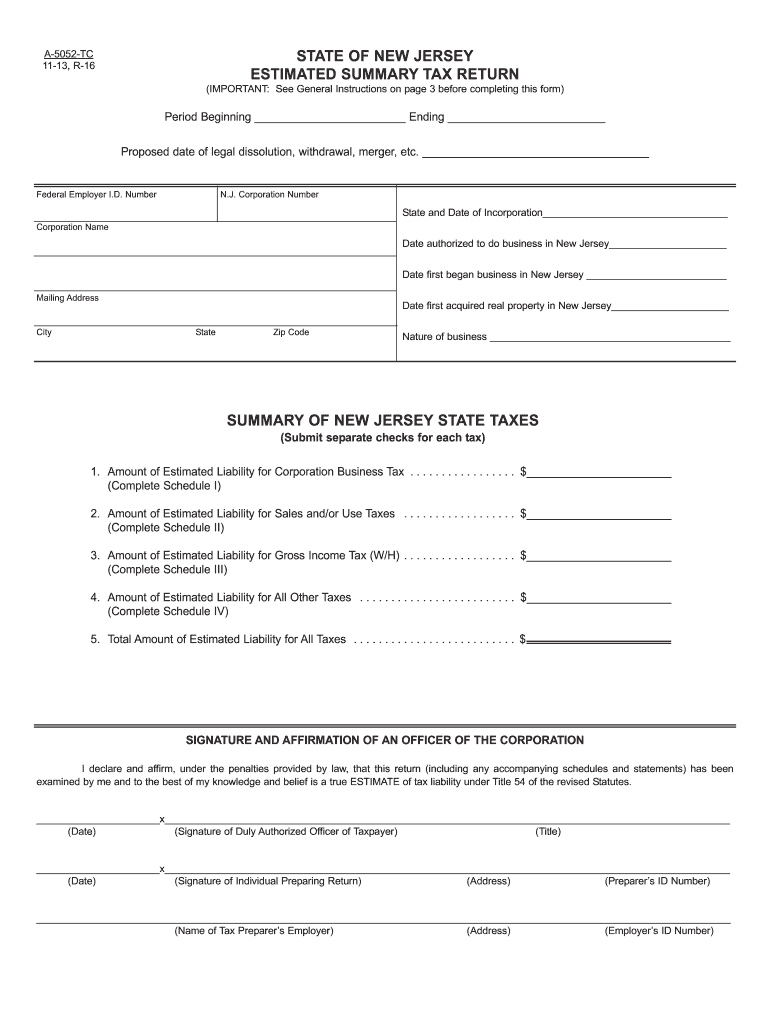

Source: www.signnow.com

Source: www.signnow.com

Arizona 140es 20222024 Form Fill Out and Sign Printable PDF Template, The last quarterly payment for 2023 is due on tuesday, jan.

Source: honeyqorelle.pages.dev

Source: honeyqorelle.pages.dev

Estimated Tax Payments 2024 Forms Lucie Robenia, They expect to owe at least $1,000 when they file.

Source: lessonschoolearwood.z21.web.core.windows.net

Source: lessonschoolearwood.z21.web.core.windows.net

Estimated Tax Forms 2024, Alternatives to mailing your estimated tax payments to the irs;

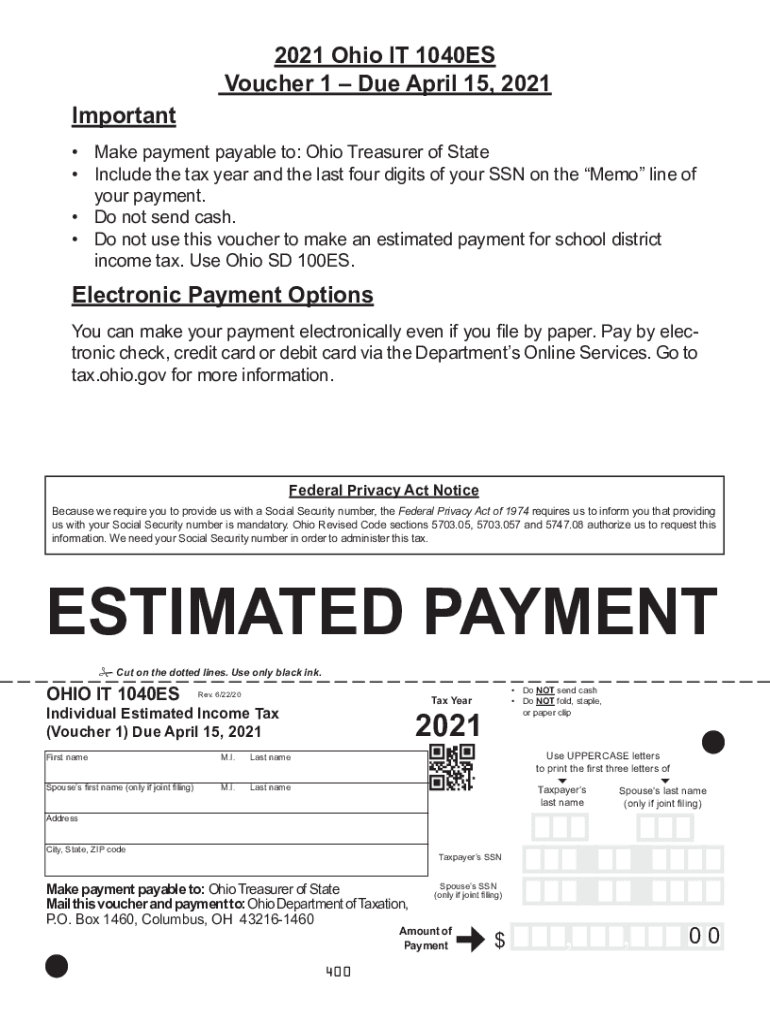

Source: www.signnow.com

Source: www.signnow.com

Ohio Estimated Tax 20212024 Form Fill Out and Sign Printable PDF, Mail a check or money order with form.

Source: arlettewwindy.pages.dev

Source: arlettewwindy.pages.dev

2024 Pa Estimated Tax Forms Brier Claudia, Individuals who did not make these payments on a timely basis may owe a.

Source: constanciawjaneva.pages.dev

Source: constanciawjaneva.pages.dev

1040 Estimated Tax Forms 2024 Meryl Robbyn, If you aren’t having taxes withheld from your paycheck, estimated quarterly taxes may be for you.

Posted in 2024